Introduction

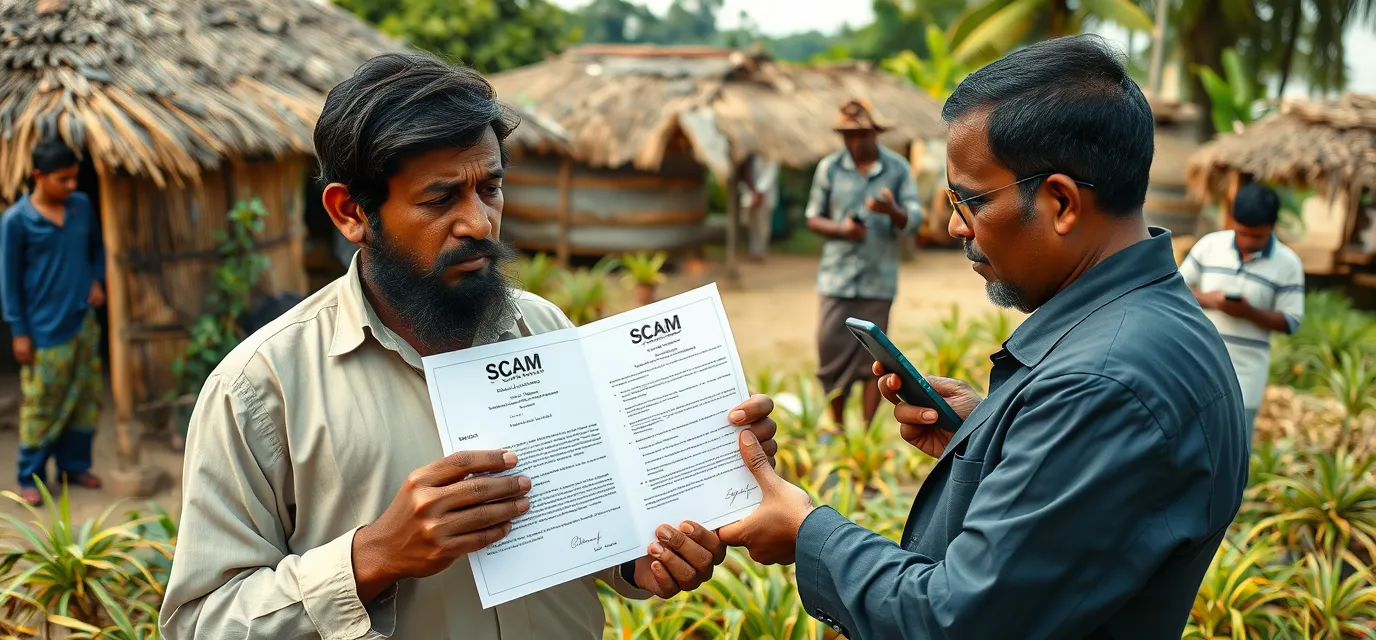

Scams are no longer limited to urban areas—fraudsters have now set their sights on rural communities. With limited access to digital literacy and banking awareness, villagers are becoming prime targets for financial fraud, fake schemes, and Ponzi traps. Let’s explore the latest scams affecting rural areas and how people can protect themselves.

#Common Scams Targeting Rural Areas

1. Fake Government Schemes & Loan Frauds

Scammers pretend to be government officials and offer fake subsidies, agricultural loans, or pension benefits. They charge villagers a "processing fee" or collect personal documents, which are later misused for fraud.

🔸 Example: Fake Kisan Loan Schemes, where farmers pay an advance fee for a loan that never arrives.

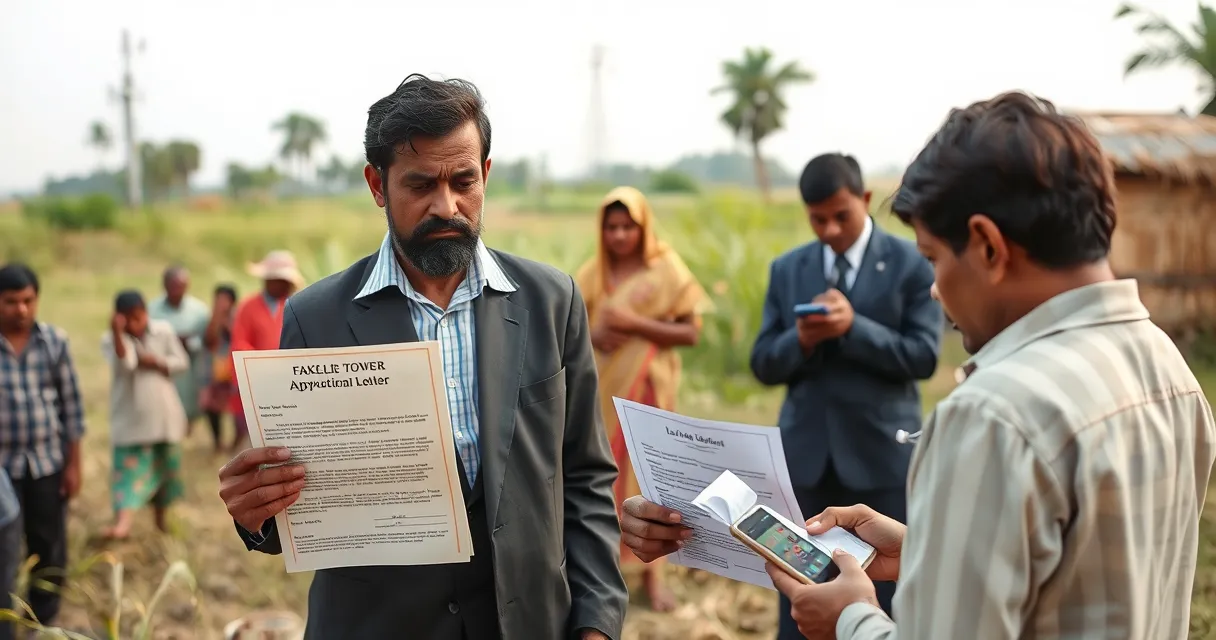

2. Mobile Tower & Land Lease Scam

Fraudsters approach landowners, promising huge monthly rent for setting up a mobile tower. They ask for security deposits, registration fees, or bribes. Once the money is paid, they disappear.

🔸 Warning Sign: No legitimate company will ask for money upfront for land leasing.

3. Online Lottery & SMS Fraud

Many villagers receive fake SMS messages claiming they have won a lottery worth lakhs. To "claim the prize," they are asked to send a processing fee or share their bank details, leading to financial losses.

🔸 Example: "Congratulations! You won ₹10 lakh in the XYZ Lottery. Pay ₹5,000 to claim your prize!" (Scam)

4. Fake Job & Work-from-Home Schemes

Fraudsters promise villagers well-paying jobs in cities or easy work-from-home opportunities. They ask for a registration fee or training charges. After collecting the money, they vanish.

🔸 Example: "Earn ₹50,000/month! Just pay ₹2,000 for training." (Scam)

5. Digital Payment & Bank OTP Frauds

With increasing use of UPI and digital banking, scammers trick villagers into sharing OTPs or PINs by posing as bank officials. They drain bank accounts within minutes.

🔸 Example: Fake calls pretending to be from a bank asking for OTP verification to "update KYC."

#🚨 How to Stay Safe (Precautionary Measures)

✅ Verify Any Government Scheme – Always check official government websites before believing any scheme.

✅ Never Pay Upfront for Jobs or Loans – Genuine jobs and banks never ask for advance payments.

✅ Be Wary of Unexpected Lottery Messages – If you didn’t enter a lottery, you didn’t win one!

✅ Do Not Share OTPs or Bank Details – Banks never ask for OTPs over the phone.

✅ Report Suspicious Activities – If a scheme seems fake, inform local authorities or police.

#Conclusion

Rural scams are rising because fraudsters exploit trust and lack of awareness. Spreading information and staying cautious is the best defense against these criminals. Share this article with friends and family in villages to help them stay protected!