In early 2025, a significant financial fraud involving the Falcon Invoice Discounting Platform came to light in India, affecting thousands of investors nationwide. This article delves into the scheme's operations, the legal actions taken, and essential precautions for potential investors.

Scheme Operations

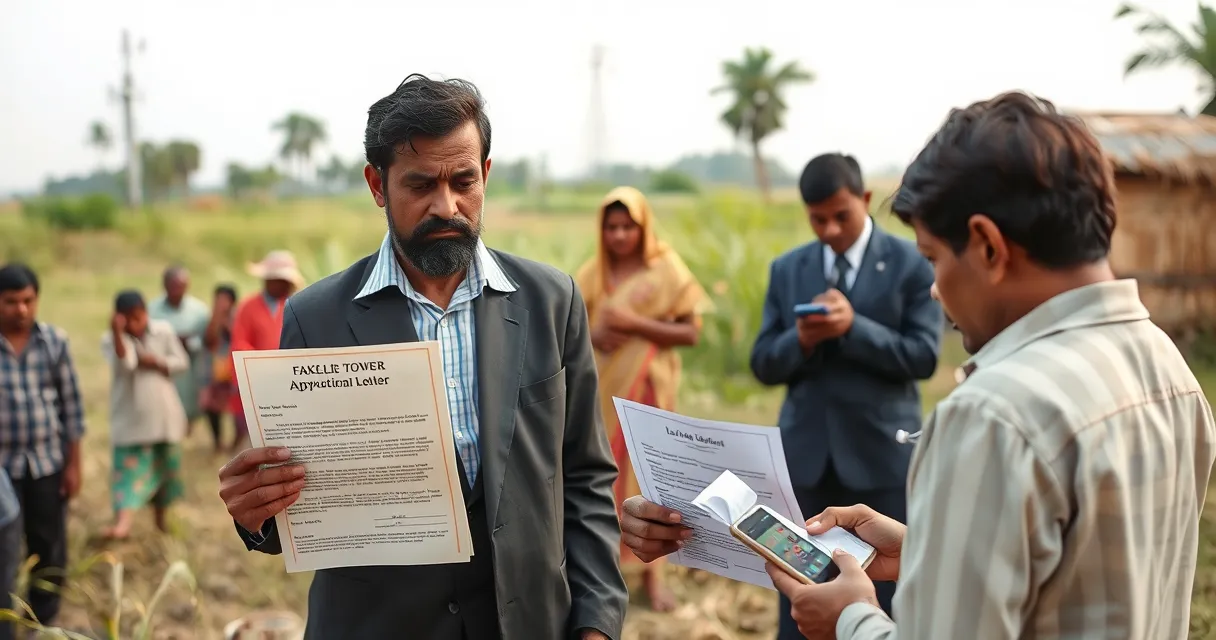

The Falcon Invoice Discounting Platform lured over 6,000 investors by promising high returns on short-term deposits, falsely claiming associations with reputable companies like Amazon and Britannia. Investors were enticed to deposit amounts ranging from ₹25,000 to ₹9 lakh for periods between 45 to 180 days. The scheme operated by using funds from new investors to pay returns to earlier ones, a classic Ponzi scheme structure. Since its inception in 2021, Falcon amassed approximately ₹1,700 crore (about $196 million) but repaid only half of this amount.

Legal Actions and Arrests

Authorities have arrested two individuals associated with the scheme; however, the primary suspect, Amardeep Kumar, founder of Falcon, remains at large. The Enforcement Directorate (ED) has initiated an investigation into the ₹850 crore fraud, issuing an Enforcement Case Information Report (ECIR) and seeking detailed information from the Cyberabad police.

Investor Impact and Precautionary Measures

Many victims discovered Falcon through social media platforms, highlighting the necessity for thorough due diligence before investing. Investors are now pursuing legal avenues to recover their lost funds. Authorities advise the public to verify the legitimacy of financial firms through official channels such as the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) before committing to investment schemes.

Conclusion

The Falcon Invoice Discounting Ponzi scheme serves as a stark reminder of the potential risks associated with high-return investment opportunities. Investors are urged to exercise caution, conduct comprehensive research, and consult financial advisors to ensure the authenticity of investment platforms. Staying informed and vigilant is crucial in safeguarding against such fraudulent schemes.